Personal debt to equity ratio calculator

Results are instantly displayed on screen. In addition to loan-to-value and combined loan-to-value ratios lenders will consider your DTI when you apply for a home equity loan or line of credit.

Debt To Equity Ratio Calculator Formula

Lenders including issuers of mortgages use it as a way to measure.

:max_bytes(150000):strip_icc():gifv()/debtequityratio_final-18c02abef4f74c1591dc9b12be962b1b.jpg)

. On this page is a Return on Equity or ROE calculator. Home equity line of credit HELOC calculator. Even if youre prepared to take the leap you may struggle to find a lender willing to work with your high DTI.

Enter a companys net income and shareholders equity and the tool will return the realized ROE. Your debt-to-income ratio DTI indicates the percentage of your monthly income that is committed to paying off debt. Lifetime Mortgage Calculator - No personal contact details required.

Credit score requirements can also vary by. A debt-to-income ratio DTI is a personal finance measure that compares the amount of debt you have to your overall income. Maximum amount that you can raise to put towards a property purchase.

To find out if you qualify your lender calculates your loan-to-value ratio by dividing the balance owing on your mortgage and any other debts secured by your property into the current value of your property. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. As a measure of financial performance it lets you see how well managements investments are performing relative to.

Personal loan is the most commonly availed loan product in the Indian debt industry. DTI ratio affects how much of your home equity you can access. Maximum amount of equity that you can release from your property.

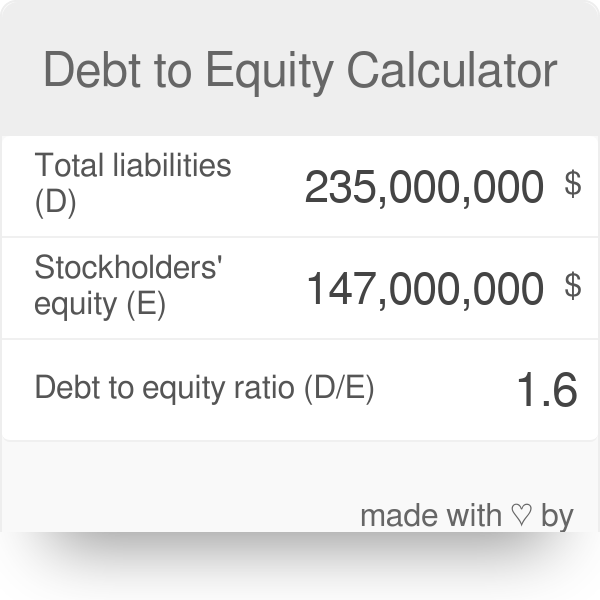

That includes debts such as credit cards auto loans mortgages home equity. To qualify for a home equity loan your debt-to-income ratio will typically need to be below 43 once your potential new loan payment is. The debt-to-equity ratio is one of the most commonly used leverage ratios.

Often youll need a credit score of around 650. You can also roughly work out your equity using this calculator. This is also known as usable equity as it is the amount you can potentially access.

Income Tax Calculator. Home equity loans have more stringent requirements than mortgages. Home equity loans usually.

Utilization calculator can help you track your debt-to-credit ratio. Second mortgage types Lump sum. Established in 1971 and with a presence in 15 states Regions offers a full lineup of personal banking services including checking and savings accounts credit cards mortgages student.

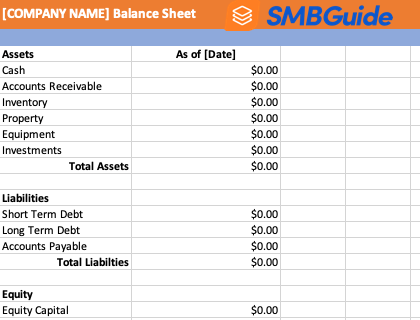

Our easy to use calculator will help you quickly determine the. Home equity calculator. If you are able to afford only a fixed amount every month to pay off debt taking out a.

The lender also looks at your monthly income and debt payments. Similarly a personal equity plan PEP. For example if you have a student loan payment of 400 a car payment of 300 and a mortgage of 1800 and make a salary of 75000 per year or 6250 per month your debt-to-income ratio stands at 40.

The 14 billion Chicago-based credit union founded in 1935 is one of the. This ratio measures how much debt a business has compared to its equity. What is a debt-to-income ratio.

The loan to value ratio or LTV is the size of the loan against the value of the property. Use this calculator to compute your personal debt-to-income ratio a figure as important as your credit score which provides a snapshot of your overall financial health. If you need money fast Alliant Credit Union typically makes same-day online personal loans between 1000 and 50000.

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Second mortgages come in two main forms home equity loans and home equity lines of credit. Therefore a mortgage loan in which the purchaser has made a down payment of 20 has a loan to value ratio of 80.

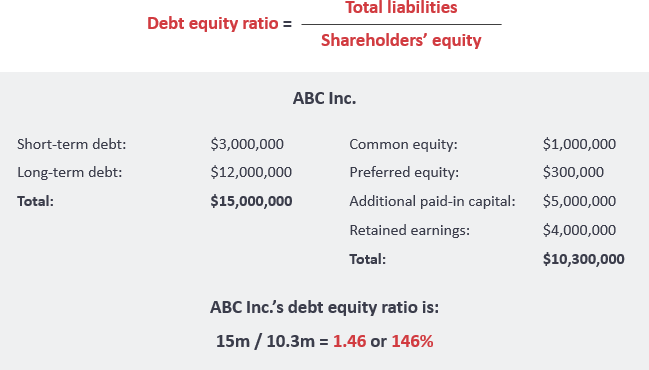

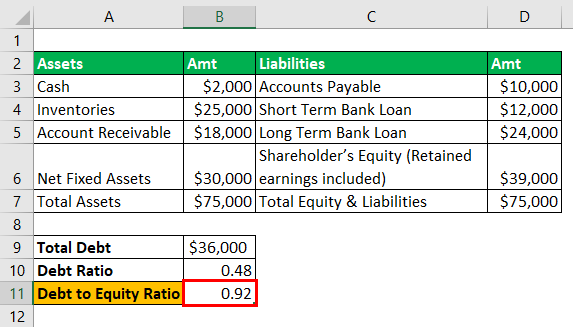

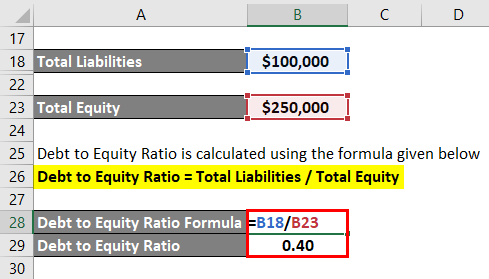

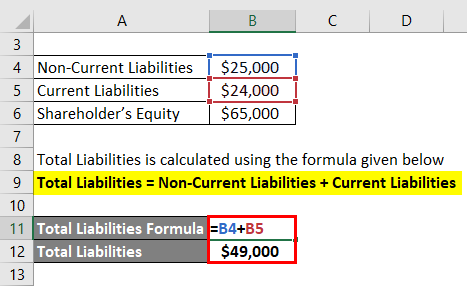

Along with being a part of the financial leverage ratios the debt to equity ratio is also a part of the group of ratios called gearing ratios. You Owe Me Rs 10 From 1977 Kbc Contestant Makes Big B Repay Debt Explains Why He Vowed To. The debt-to-equity ratio is calculated by dividing total liabilities by shareholders equity or capital.

Step by Step guide on how to calculate Income Tax tax slabs online. Personal Loan EMI Calculator Calculate Your Personal Loan EMI Online. The interest rates and costs involved.

Our DSCR calculator enables you to calculate your companys debt service coverage ratio DSCR with ease. Debt to Equity Ratio - What is it. Tap your home equity.

Debt to Equity Ratio Formula Example. However every lender will look at your credit score income and debt-to-income ratio to determine how capable you are of repaying your loan. As you consider buying a home its important to get familiar with your debt-to-income ratio DTIIf you already have a high amount of debt compared to your income then moving forward with a home purchase could be risky.

So for example if the market price of your property is 850000 and your outstanding loan balance is 500000 you have up to 350000 of equity. Calculate Your EMI Online in Easy Steps. Freelance writer since 2012and a personal.

Over 78 of all credits availed in India fall under this category. If you make a down payment of less than 25 you typically need a credit score of at least 680 and low debts or 720 with a higher debt-to-income ratio. The unsecured nature of these loans makes them a popular choice among prospective borrowers.

If your loan-to-value ratio is lower than 80 you can refinance. If youre a homeowner with strong credit and financial discipline tapping your home equity could be a good debt consolidation option for you. A debt-to-income ratio is the percentage of gross monthly income that goes toward paying debts and is used by lenders to measure your ability to manage monthly payments and repay the money borrowed.

What is the debt-to-income ratio to qualify for a home equity loan. For commercial lenders the debt service coverage ratio or DSCR is the single-most significant element to take into consideration when analyzing the level of risk attached to an investment property or business. How to calculate Income Tax using Income Tax Calculator by The Economic Times.

Interest rates for home equity loans are significantly lower than rates on many other types of debt. Is the ratio of a businesss net profit or income to shareholders equity. In the previous example the company with the 50 debt to equity ratio is less risky than the firm with the 125 debt to equity ratio since debt is a riskier form of financing than equity.

This is typically generated by an amortization calculator using the following formula. There are two kinds of DTI ratios front-end and back-end which are typically shown as a percentage like 3643.

How Do You Calculate The Debt To Equity Ratio

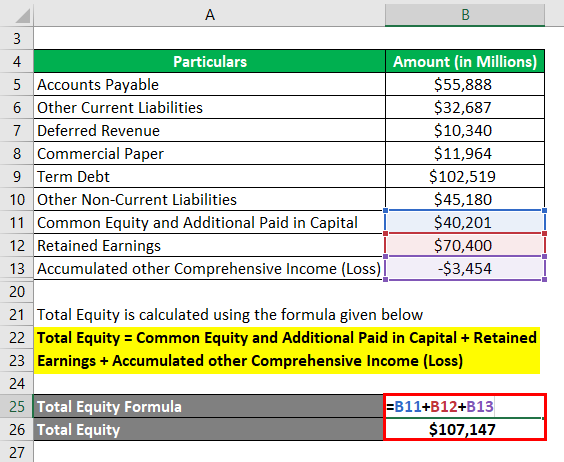

Debt To Equity Ratio D E Formula And Calculator Excel Template

Debt To Equity Ratio Calculator

Debt To Equity Ratio Definition Formula Example

How To Calculate The Debt Service Coverage Ratio Dscr Propertymetrics

Gearing Ratio Formula And Calculator Excel Template

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Leverage Ratios Formula Step By Step Calculation With Examples

:max_bytes(150000):strip_icc():gifv()/debtequityratio_final-18c02abef4f74c1591dc9b12be962b1b.jpg)

Debt To Equity D E Ratio Formula And How To Interpret It

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio Definition Formula Example

:max_bytes(150000):strip_icc()/debtequityratio.asp_FINAL-0ac0c0d22215418a992fa7facd2354e6.png)

Debt To Equity D E Ratio Formula And How To Interpret It

Debt To Equity Ratio What It Is And How To Calculate It

Debt To Equity Ratio Formula Calculator Examples With Excel Template

Debt To Equity Ratio D E Formula And Calculator Excel Template

How Do You Calculate The Debt To Equity Ratio

How Do You Calculate The Debt To Equity Ratio